Read this article in French

Read this article in French- Share this article

- Subscribe to our newsletter

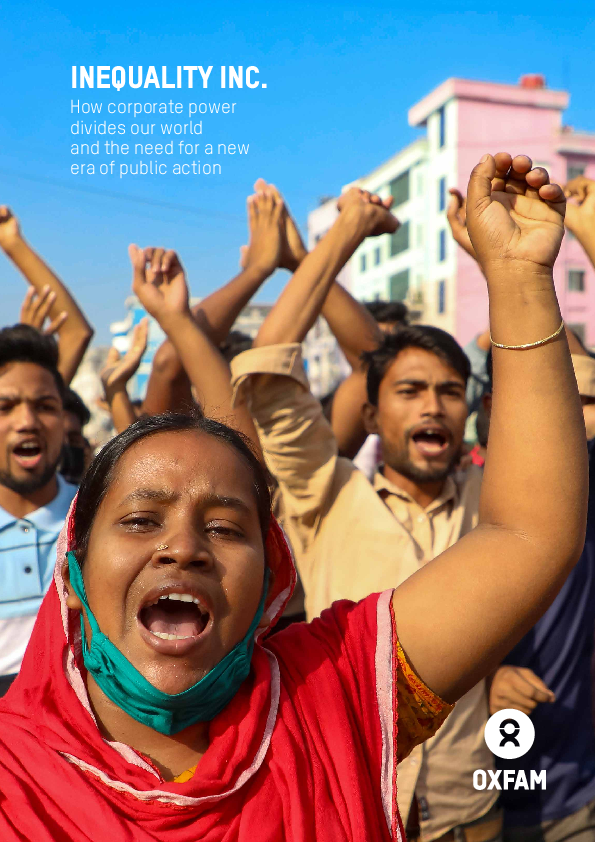

Inequality Inc.

The EU’s five richest billionaires have increased their wealth by 76 per cent since 2020, from 244 billion to 429 billion euros. That’s a rate of 5.7 million euros per hour. At the same time, 99 per cent of the EU’s population has become poorer. This is the finding of a new report entitled Inequality Inc. – How corporate power divides our world and the need for a new era of public action, published by Oxfam in January 2024. The report also reveals that if current trends continue, the world will have its first trillionaire within a decade, but poverty will not be eradicated for another 229 years.

Market concentration is also increasing, the report shows. Globally, corporations have undergone major consolidation. Two global companies control over 40 per cent of the global seed market (compared with 10 companies owning 40 per cent of the global seed market 25 years ago) and four firms control 62 per cent of the world’s pesticide market.

Seven out of ten of the world’s biggest corporations have a billionaire as their CEO or principal shareholder. These corporations are worth 9.3 trillion euros, equivalent to more than the combined GDPs of all the countries in Africa and Latin America.

Despite representing less than 6 per cent of the global population, the EU hosts 15 per cent of the world’s billionaires and 16 per cent of global billionaire wealth. Since 2020, billionaires in the EU have increased their accumulated wealth by one-third, reaching 1.9 trillion euros last year.

A progressive wealth tax on EU multi-millionaires and billionaires between 2 and 5 per cent could raise 286.5 billion euros each year. This could pay 40 per cent of the EU’s recovery fund.

Mirroring the fortunes of the super-rich, 22 of some of the biggest companies in the EU made 172 billion euros in net profit from July 2022 to June 2023. This is 66 per cent more than their average profit for 2018 to 2021.

Oxfam’s report also provides evidence of a “war on taxation” by corporations. In the EU, the corporate tax rate fell from 32.2 per cent in 2000 to 21.5 per cent in 2023. Globally, only 4 per cent of the 1,600 largest companies publicly disclose their global tax strategy and the corporate income tax paid in all countries.

People worldwide are working harder and longer hours, often for poverty wages in precarious and unsafe jobs. The wages of nearly 800 million workers have failed to keep up with inflation and they have lost 1.4 trillion euros over the last two years, equivalent to nearly a month (25 days) of lost wages for each worker.

(Oxfam/ile)

Read more and download the report on the Oxfam website

Add a comment

Be the First to Comment