Download this article in magazine layout

Download this article in magazine layout

- Share this article

- Subscribe to our newsletter

Local biopesticide production hubs and the empowerment of rural women in Tamil Nadu, India

Cottage industries feature home-based systems of manufacturing on a small scale. In most cases, these industries make use of locally available raw materials, and they often benefit from indigenous skills and knowledge. Cottage industries play an important role in the Global South, especially in Asia and Latin America. Whilst economic development is the most attractive gain of cottage industries, studies have found that other social goals are achieved, including independence, decision-making opportunities and poverty reduction.

Against this background, cottage industries are also of considerable importance for women. They have helped women in parts of the developing world to improve their ability to define and act on goals, make decisions that matter to them, and participate in the economy and public life. In Tamil Nadu, India, several women’s cottage industries producing biopesticides have been established, with the support of the MS Swaminathan Research Foundation (MSSRF). Most are linked to local plant clinics (see Box) that refer farmers to them when plant pests and diseases have been detected in their fields.

Women’s economic empowerment put to the test

In Tamil Nadu, the first plant clinics were established in 2011, and became fully operational in 2014. Women’s cottage industries existed during this time, but were not commercially viable. It was however observed that as the plant clinics became operational, there was a positive and increasing trend in the number of clients visiting cottage industries for their products. This was because they were referred to the women’s cottage industries by the plant doctors. It was further observed that the women who were members of these local cottage industries became more confident and were better able to articulate themselves and engage in other spheres of the community.

To find out what the source of this ‘confidence’ was, and to determine how other women’s groups could learn from them, we conducted a survey in the Tamil Nadu area during the months of July and August 2021. A total of thirty-four women who are members of several cottage industries producing eco-friendly agricultural products including biopesticides were randomly selected and interviewed. We assessed empowerment by analysing four indicators: decision-making, productive capital ownership, access to and control of credit and finance, and leadership as evidenced by group membership.

Household decision-making. Evidence from various studies suggests that when women participate significantly in household decision-making processes, the overall well-being of the family improves. We therefore analysed women’s involvement in their households’ decision-making processes. With a share of 97 per cent, the majority of the women whom we interviewed are from households headed by men. In most of the households, the male spouse mainly makes the farming decisions pertaining to food crops (62 %) and cash crops (59 %). Women are much more equally involved in decision-making processes concerning livestock production (35 %; men: 32 %) and, as stated by nearly 97 per cent of all surveyed women, are fully in control of the decisions pertaining to non-farm activities, including their involvement in the cottage industry.

Most women surveyed are engaged to some extent in making decisions in their households about how income from cash crops (82 %), food crops (68 %) and livestock production (69 %) is utilised. Utilisation of income from non-farm activities, including that from the cottage industry, is controlled by the women themselves in the majority of surveyed households (94 %).

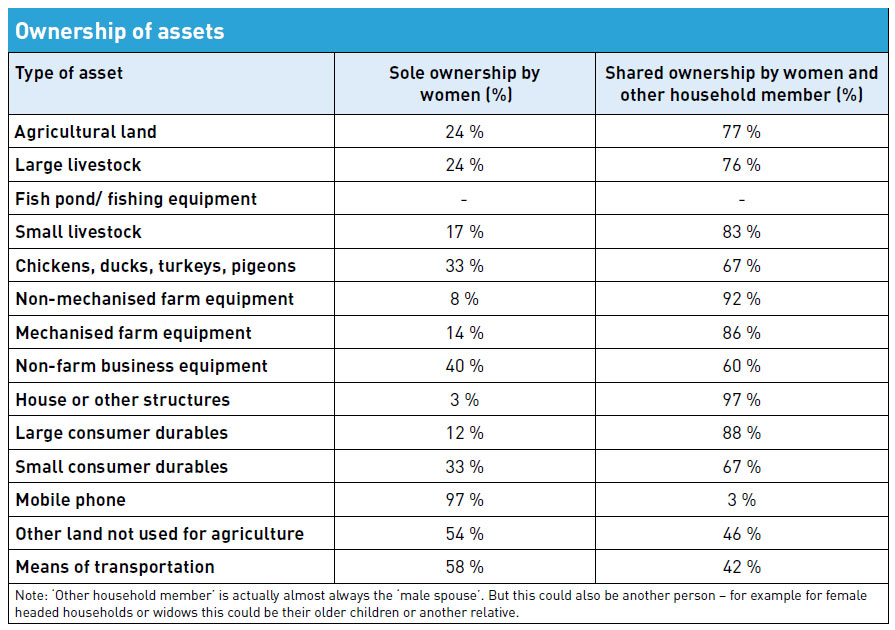

Access to productive capital. Asset ownership is one measure of economic empowerment. Access to productive capital, such as land, livestock, farm implements and households’ assets, has a significant role in enhancing the livelihood outcomes of rural households. Productive assets help rural households to manage natural and economic shocks and risks, smooth consumption and manage income. We analysed access to 14 productive assets. The women we interviewed are from households with access to a wide variety of productive capital with all the women saying that in their households they have agricultural land, a house or other building structure and large consumer durable assets.

With most large assets, women we interviewed were less likely to have sole ownership (see Table). For example, we found that amongst the surveyed women, a very small proportion had sole ownership of agricultural land, large livestock like cattle or mechanised farm equipment such as tractors or water pumps. On the other hand, non-agricultural land for a residential or commercial building and means of transport such as motorbikes or push bicycles were more likely to be solely owned by a woman. Amongst the women we interviewed, we found that in each case, just over half had sole ownership of non-agricultural land and means of transport.

In almost all the surveyed women’s households, women have sole ownership of a mobile phone. With mobile phones, information pertaining to various developmental issues, including agricultural and health services, can be delivered, and they can help access credit and finance and be useful in many other ways. Therefore, mobile phone ownership has been found to be empowering for rural women across the globe.

Access to credit. Access to finance, especially micro-credit, is seen by some development experts as a cure-all for rural women’s empowerment. Others however argue that, especially on its own, without other social benefits, outside the broader poverty reduction sphere, access to credit is insufficient for women’s empowerment and can result in undesired outcomes. For example, studies from Bangladesh found that microfinance led to increased levels of debt amongst already poor households and worsened economic, social and environmental vulnerabilities. A study from Ghana, on the other hand, states that the benefits of microfinance were linked to conflicts amongst spouses and the neglect of perceived female domestic responsibilities due to women’s devotion to their enterprises.

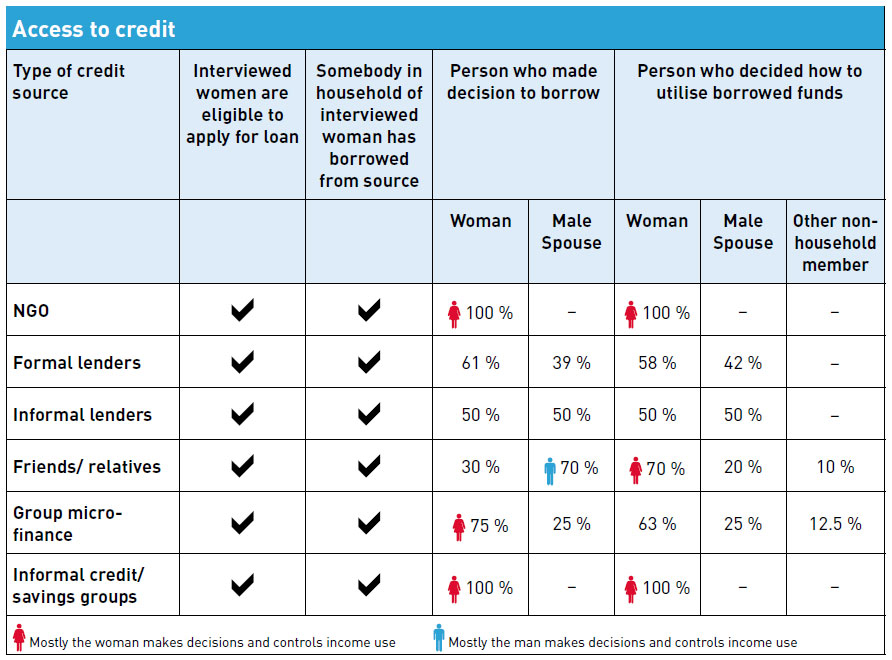

However, credit remains one of the necessary ingredients for increasing and accelerating rural women’s empowerment. On this basis, we therefore analysed access to as well as control over finance and credit services of the surveyed women. All of them have various sources of credit and finance in their communities, and from each category of credit, there are women who are eligible to borrow. At 53 per cent, over half of the women interviewed stated that their households were eligible to borrow from formal lenders. Just under a third of the surveyed women also say that their households are able to borrow from friends and relatives, and just over 20 per cent maintain that their household is able to borrow from group micro-financing schemes.

Amongst those reporting that they are eligible to borrow, somebody from their household has borrowed from the available source of funding. This implies that those who are able to borrow (i.e. are eligible) always do so when credit is available. The decision by the surveyed women to get credit from a particular source is mostly in their hands for most sources, except for borrowing from friends and relatives or from informal lenders (see Table).

It should be noted that in cases in which credit facilities are via groups (i. e. NGO-based schemes, group microfinance schemes and informal credit and loan groups), it is the woman who has control in terms of the decision to borrow from that source or not. This can be attributed to most groups being gender-segregated, with women staying in their own groups, as with the case of the cottage industries under study. We can further see from the Table that all women who borrow from NGOs and informal credit and savings groups have full control in decisions on how the funds are utilised. This can be attributed to the fact that before funds are dispersed by an NGO or savings and credit groups, the women must provide a “business case” – albeit informal – stating what they intend to use the funds for and how they will repay the loan.

For all other sources of credit, the spouse or other individuals from outside the household contribute to decisions on how borrowed funds should be utilised. These findings imply that community groups, especially those that are gender-segregated are key for women’s access to and control over credit. Whether access to credit produces unintended/ undesired outcomes, as discussed briefly above, is beyond the scope of this study, but is an area that should be considered prior to the establishment of any development programme that wishes to use credit and finance schemes as a means of contributing towards rural women’s empowerment.

Group membership. From our findings above, we see that women’s participation in community groups can be empowering as it allows them to access and control credit and finance. We find that on average, at 80 per cent, a large proportion of surveyed women who live in a community where a community group exists are active in such a group. This includes agricultural producer groups, microfinance groups, mutual help or insurance groups, trade and business association groups and other types of women-only groups. This is an important finding as many other studies have demonstrated that rural women participating in community groups tend to be more empowered than women not doing so. One leader of a cottage industry stated: “I had the confidence to join several groups in my community, after seeing the benefits of being part of my cottage industry.”

Field practitioners and policy-makers should therefore continue to provide support for the establishment of community groups as a means to reach women and as a tool for increasing women’s empowerment. The type of participation that the women have in the groups and the benefits that accrue from different groups for the women and their families or household are beyond the scope of this study, but represent an area that should be considered for future research.

Summing up …

Women in India’s Tamil Nadu who are engaged in cottage industries have increased their empowerment via the operation of local production hubs for biopesticides that are linked to a network of plant clinics. We have seen evidence of empowerment in several aspects:

- Women have control over their participation in and income from cottage industries. This means that supporting cottage industries has potential to increase the empowerment of women who participate.

- Most productive capital and assets are jointly owned within a household by women and the male spouse. However women have sole ownership of mobile phones. This has many positive implications, including the delivery of agriculture, health and finance services via mobile-based applications.

- Women participate in household decision-making processes, and they have control in decision making related to accessing and utilising credit and finance from group-based lending. These findings imply that community groups, especially those that are gender-segregated, are key for women’s access to and control over credit.

- Participation in community groups amongst interviewed women is very high, implying that community groups are held in high esteem and should be promoted and supported as a vehicle for increasing women’s empowerment.

There is need for both public and private promoters to continue supporting the development of women’s cottage industries as participation in these industries can contribute to women’s empowerment. Our study also shows that links between key industry players and cottage industries which the women are operating can catalyse the operations of the cottage industries, leading towards economic viability. This is the case with the plant clinics in Tamil Nadu, which acted as a business catalyst for the local biopesticide hubs operated by the women’s cottage industries.

Mariam Kadzamira is a Senior Agribusiness Researcher at the Centre for Agriculture and Biosciences International (CABI) and is based in the UK. She holds a PhD in Agriculture Economics from the University of Pretoria, Republic of South Africa.

Malvika Chaudhary is the Asia Regional Coordinator for the Plantwise Programme at CABI India. She holds a PhD in Zoology from Dr Bhimrao Ambedkar University, Agra, India.

Ramasami Rajkumar is a Senior Scientist at M S Swaminathan Research Foundation (MSSRF), India. He holds a PhD in Agriculture Economics from Bharathidasan University.

Frances Williams is the Global Monitoring and Evaluation Manager at CABI. Her work focuses on embedding monitoring and evaluation systems within CABI and its projects.

Contact: m.kadzamira(at)cabi.org

References

Banerjee, S.B. and Jackson, L. 2016. and Microfinance and the business of poverty

reduction: Critical perspectives from rural Bangladesh. Human Relations. 70(1) 63–91

Bentley, J., Boa, E., Almendras, F., Franco, P., Antezana, O., Dı´az, O., Franco, J. and Villarroel, J. 2011. How farmers benefit from plant clinics: an impact study in Bolivia. International Journal of Agricultural Sustainability. 1–16, doi:10.1080/14735903.2011.583482.

Desai, S., Misra, M., Das, A., Singh, R.J., Sehgal, M., Gram, L., Kumar, N. ad Prost, A. 2020. Community interventions with women's groups to improve women's and children's health in India: A mixed-methods systematic review of effects, enablers and barriers. BMJ Global Health. 5 (12).

Fernando, J. 1997. Nongovernmental Organizations, Micro-Credit, and Empowerment of Women. Annals of the American Academy of Political and Social Science. 554 (1): 150–177.

Joy, A.M.T and Kani R.M. 2013. Emerging Opportunities and Challenges for Cottage Industries in India. International Journal of Scientific and Research. 3(3): 1 – 4.

Kazianga, H. and Udry, C. 2006. Consumption smoothing? Livestock, insurance and drought in rural Burkina Faso. Journal of Development Economics. 79 (2): 413-446.

Khan, S.T., Bhat, M.A. and Sangmi, M.A.D. 2020. Impact of Microfinance on Economic, Social, Political and Psychological Empowerment: Evidence from Women’s Self-help Groups in Kashmir Valley, India. FIIB Business Review. DOI:10.1177/2319714520972905.

Kumar, N., Raghunathan, K., Arrieta, A., Jilani, A. and Pandey, S. 2021. The power of the collective empowers women: Evidence from self-help groups in India. World Development. 146.

Kusuma, A., Tutiasri, R.P., Romadhona, M.R. and Khasanah, U.U. 2020. Rural Women Entrepreneur in Digital Era. Advances in Social Science, Education and Humanities Research. 423.

Mayoux, L. 2000. Micro-finance and the Empowerment of Women – A Review of Key Issues. SFP Working Paper 23.

Othman, M.S., Garrod, G. and Oughton, E. 2021. Farming groups and empowerment of women smallholder farmers. Development in Practice. 31(5): 676 – 689. DOI: 10.1080/09614524.2021.1911947.

Pandey, V. 2013. Trends, Opportunities and Challenges in Small Scale and Cottage industries in Uttar Pradesh. Asian Journal of Technology and Management Research. 03 (02).

Peterman, A., Pereira, A., Bleck, J., Palermo, T., Yount, K.M. 2017. Women’s individual asset ownership and experience of intimate partner violence: Evidence from 28 international surveys. American Journal of Public Health. 107(5): 747-755.

Pitt, M. M.; Khandker, S. R.; and Cartwright, J. 2003. Does Micro-Credit Empower Women : Evidence from Bangladesh. Policy Research Working Paper No. 2998. World Bank, Washington, DC.

Rajkumar, R. and Anabel, N.J. 2018. The role of plant clinics in addressing pest and disease management. CSIT 6:279–288. https://doi.org/10.1007/s40012-018-0210-3.

Salia, S., Hussain, J., Tingbani, I. and Kolade, O. 2018. Is women empowerment a zero-sum game? Unintended consequences of microfinance for women’s empowerment in Ghana. International Journal of Entrepreneurial Behavior & Research, 24 (1): 273-289. https://doi.org/10.1108/IJEBR-04-2017-0114.

Sell, M. and Minot, N. 2018. What factors explain women's empowerment? Decision-making among small-scale farmers in Uganda. Women's Studies International Forum. 71: 46-55.

Silvestri, S., Macharia, M., and Uzayisenga, B. 2019. Analysing the potential of plant clinics to boost crop protection in Rwanda through adoption of IPM: the case of maize and maize stem borers. Food Security. 11:301–315. https://doi.org/10.1007/s12571-019-00910-5.

Singh, S. 2018. Microfinance and the Mirage of Women’s Empowerment. E-International elations.

https://www.e-ir.info/2018/10/01/microfinance-and-the-mirage-of-womens-empowerment/

Tambo, J.A., Uzayisenga, B., Mugambi, I., Bundi, M., Silvestri, S. 2020. Plant clinics, farm performance and poverty alleviation: Panel data evidence from Rwanda. World Development. 129. https://doi.org/10.1016/j.worlddev.2020.104881.

Tambo, J.A., Uzayisenga, B., Mugambi, I. and Bundi, M. 2021a. Do Plant Clinics Improve Household Food Security? Evidence from Rwanda. Journal of Agricultural Economics. 72(2): 97 -116. https://doi.org/10.1111/1477-9552.12391.

Tambo, J.A., Romney, D., Mugambi, I., Mbugua, F., Bundi, M., Uzayisenga, B., Matimelo, M. and Ndhlovu, M. 2021b. Can Plant Clinics Enhance Judicious Use of Pesticides? Evidence from Rwanda and Zambia. Food Policy. DOI: 10.1016/j.foodpol.2021.102073.

Tariq, S. and Sangmi, M.D. 2018. Microfinance and Women empowerment: A Brief Review of Literature. Pacific Business Review International. 11(3):77-83.

Tariq, S. and Sangmi, M.D. 2019. Impact of microfinance on women entrepreneurship. Arabian Journal of Business and Management Review. 8(1): 7- 16. DOI: 10.12816/0052847.

Tariq, S. and Sangmi, M.D. 2020. Microfinance and Women's Economic Empowerment: An Experimental Evidence. Abhigyan. 38(3).

Tatwangire, A. 2011. Access to Productive Assets and Impact on Household Welfare in Rural Uganda. PhD Thesis. Department of Economics and Resource Management. Norwegian University of Life Sciences.

Zimmerman, F. J. and Carter, M. R. 2003. Asset smoothing, consumption smoothing and the reproduction of inequality under risk and subsistence constraints. Journal of Development Economics. 71 (2): 233-260.

Add a comment

Be the First to Comment